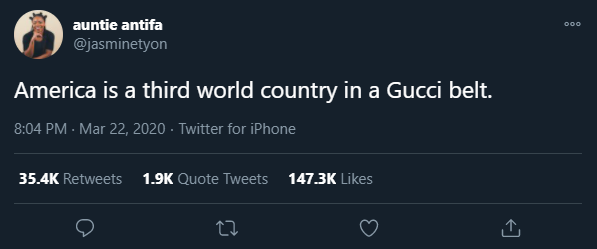

This is a surprisingly and unfortunately accurate tweet that has been stuck in my head this year. Although this tweet seems to be aimed with a humorous intent, the painful reality of this message has been brought to light this year. The truth is, many Americans have been putting on a false facade of wealth and status for a while now. In a study of over 2,000 people, 53% of people said they were living paycheck to paycheck [1]. In a 2019 study, 28% of people had no savings and 25% had less than 3 months of expenses saved [2]. Without savings in the bank to support any fluctuation in monthly income, living paycheck to paycheck makes one very vulnerable to any unexpected financial turns. But as long as a steady job provides a consistent paycheck, it doesn’t feel like there is much risk. The bills get paid as long as everything goes as planned, right? Enter Covid 19.

Unemployment jumps to 14.7% - a rate surpassing even that seen in the Great Depression [3]. 25% of people had trouble paying their bills, 33% dipped into savings or retirement funds, and 16% had trouble paying rent/mortgage [4]. So how did we get here? The obvious scapegoat is the Covid 19 outbreak. Although the virus had an undeniably detrimental effect on the economy, amongst other things, we were thoroughly unprepared for a disruption of the status quo. 44% admitted to living beyond their means before the pandemic, 67% of people regret not having enough savings [1], and in 2018 the average (non-mortgage) debt load was over $34,000 per person [5].

So what made us so vulnerable to a world-wide hiccup? Truthfully, most people weren’t taught how to (or that it is important to) adequately manage their finances - save for a rainy day, get out of debt, and live below their means. Unfortunately that wasn’t part of the typical curriculum, but most people know that Mitochondria is the powerhouse of the cell! Rather than proper personal finance management, we’ve been force fed the idea that you should be an over-indulgent capitalist, buying anything you want. That’s totally normal! And if you don’t have the money to keep up with the Jones's? Take out some debt! Well that’s exactly what the Jones’s did and let me tell you a secret: The Jones’s are broke!

All these statistics to say - “normal” isn’t working! It is my mission today to shake you out of the normal habits and show you how to be “weird”. About a year and a half ago, I was very normal. I had student loans, a car loan, and balances on several credit cards totaling in excess of $55,000. I had no savings in the bank and worst of all, no financial plan. I read Dave’s book The Total Money Makeover and clawed my way out of debt in 15 months. I am proud to no longer be “normal”. Dave’s book and his class Financial Peace University (FPU) have fundamentally changed how I view and handle money.

Now that I am out of debt and on a plan, I have made it my mission to share this blessing of knowledge with others. I am teaching a FPU class starting January 27th. In this class you will learn how to budget, get out of debt, build lasting wealth amongst other things through the implementation of Dave Ramsey’s 7 Baby Steps.

The turmoil experienced in 2020 shined a light on our Gucci belts and the underprepared people wearing them. 2021 is our chance to sell the Gucci belt, put some hard working clothes on, and prepare for the next time it rains! This is the year where you finally decide to understand and take control of your finances; I’d be honored to show you how!

Start a free trial of Ramsey+ to check out the first couple lessons of my virtual FPU class starting January 27th:

https://www.financialpeace.com/classes/1130549

Or if you’d prefer a private financial coaching meeting, contact me directly:

Jake Faust

(480) 266-4175

jake.faust2012@gmail.com

Leave a comment (all fields required)

Comments will be approved before showing up.